Energy Partner

of Choice

PTT Exploration and Production Public Company Limited (PTTEP) conducts business in petroleum exploration, development and production, renewable energy, new forms of energy, and advanced technology emphasizing greenhouse gas emissions reduction toward the low-carbon and sustainable future.

Company OverviewInvestor Overview

Top Story

Latest News

April 01, 2025

PTTEP holds 2025 Annual General Shareholders’ Meeting as a sustainable event

Explore More

March 26, 2025

PTTEP wins 2 global awards in innovation and knowledge management for 4th consecutive year

Explore More

March 06, 2025

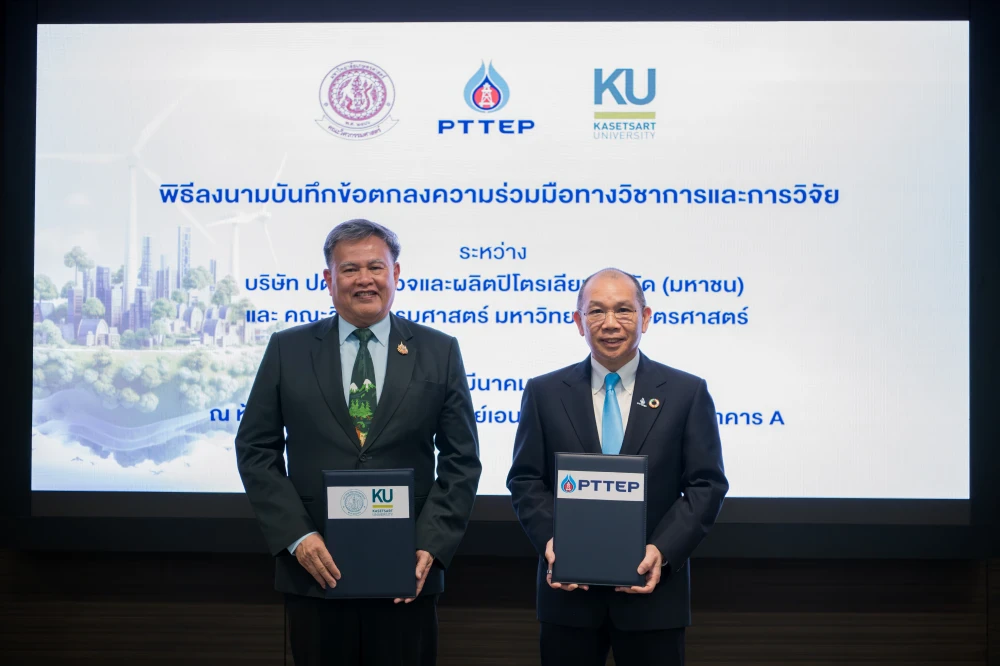

PTTEP collaborates with KU to foster research and innovation for the future of energy

Explore More

EP Net Zero 2050

A pathway for PTTEP to reach net zero greenhouse gas emissions by 2050

Carbon Capture & Storage

A key technology for reducing GHG emissions

Corporate Governance

PTTEP adheres to good corporate governance and business ethics.

Life at PTTEP

PTTEP believes that human resources are significant driving forces propelling the company towards sustainable future.